Financial Briefs

Email This Article To A Friend

Strategic Investing Amid The Hot Labor Market

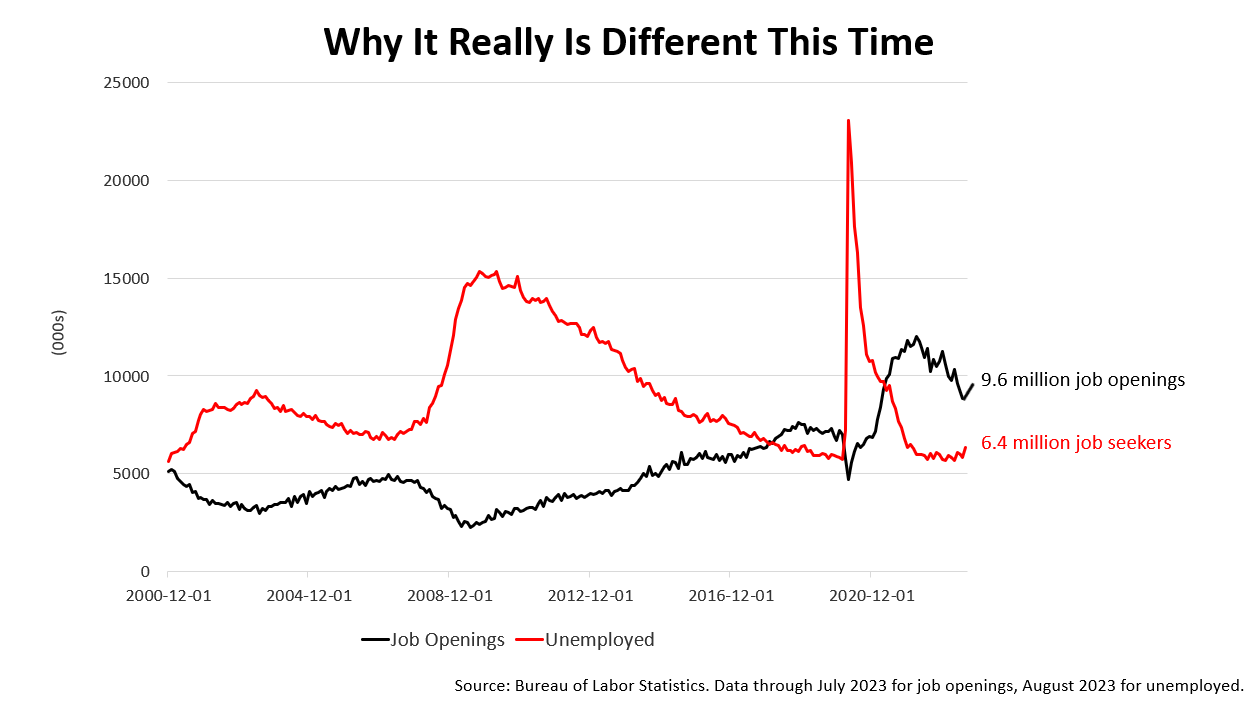

The number of job openings increased to 9.6 million on the last business day of August, the U.S. Bureau of Labor Statistics reported Tuesday, much more than the 8.8 million expected by Wall Street. It’s good news. If demand for workers stays this strong, a recession is unlikely because the number of workers earning income and spending will continue to rise as openings are filled in the weeks ahead.

Historically, job seekers outnumber job openings, as illustrated in the black line running below the red line for most of the past two decades. However, since the pandemic, the black line’s been considerably higher than the red line. The gap has narrowed in the past year but moved much higher in August and the job market remains tight. Labor market strength makes the Federal Reserve likely to keep lending rates higher for longer, which could lower stock prices but makes a soft landing easier. That’s what long-term investors in stocks care about most.

In its quest to kill inflation without causing a recession by raising rates so much that it causes a recession – two consecutive quarters of a economic shrinkage – Fed policymakers can do nothing for now. The 12 rate hikes imposed since March 2022 have already slowed economic growth in recent months, as evidenced in weakening new-job creation, declining residential housing construction, and lower activity of monthly surveys of purchasing managers.

The hotter than expected job openings figure makes a hike in lending rates less likely. At the next meeting of central bankers on Nov. 1, the Fed may do nothing, patiently leaving the highest rates in two decades to continue to slow growth.

Tuesday’s hot job-openings sent bond prices tumbling and yields much higher, to a level not seen since uncertainty in 2007. The yield on a 10-year Treasury Note, a benchmark of long-term bonds, rose to 4.8%, while the Fed funds rate was about 5.4%. The yield curve is grossly inverted. An inverted yield curve, in the past, presaged recessions. But the yield curve has been inverted all year long and the current economic expansion has continued to remain strong – much to the surprise of consensus forecasts of leading economists.

The post-Covid economy has been filled with a chain of anomalies increasing uncertainty: a partial shutdown of the economy, massive government stimulus, an explosion in money held in cash, checking, and savings accounts, an unexpected drop in the labor participation rate, and changing immigration trends, as well as the 18-month most aggressive monetary tightening campaign in modern U.S. history. The confluence of anomalies has defied expectations for a recession and the new job openings figure confirms that a recession is not in sight, confounding expectations again.

The jobs data confirms a soft landing or no landing at all is reasonable to expect. For long-term strategic investors who are broadly diversified in stocks, bonds, cash, and real estate as well as other asset classes, this is a good perspective to keep top of mind. Diversification doesn't guarantee investment returns or eliminate risk of loss including in a declining market. Diversification, however, can reduce unsystematic risk specific to a particular company or investment.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.